Mastering Prop Firm Strategy: Keys to Trading Success

In the fast-paced world of finance, proprietary trading firms, commonly known as prop firms, have carved out a significant niche. These firms utilize their own capital to engage in trading financial instruments, creating opportunities for both skilled traders and savvy investors. Understanding the prop firm strategy is essential to unlock the potential for profit and efficiency in trading. This article delves into the core principles of prop trading strategies, emphasizing their importance in risk management and financial success.

What is a Prop Firm?

A proprietary trading firm is a company that engages in trading various financial instruments using its own capital rather than relying on client funds. This approach allows firms to maximize their profit potential while deploying a range of trading strategies across multiple asset classes. By investing the firm’s own capital, prop firms can aggressively pursue opportunities that traditional investment companies might avoid due to fiduciary responsibilities to clients.

Core Elements of Prop Firm Strategy

To effectively implement a prop firm strategy, it is crucial to understand the various components that define successful trading. These include:

- Market Analysis: Understanding market trends, indicators, and investor behavior is paramount.

- Risk Management: Developing techniques to minimize losses while maximizing returns.

- Trading Psychology: Mastering emotional discipline to avoid impulsive decisions.

- Technology and Tools: Utilizing advanced trading platforms and algorithms to gain a competitive edge.

- Strategy Development: Creating a specific approach tailored to meet the firm's trading goals.

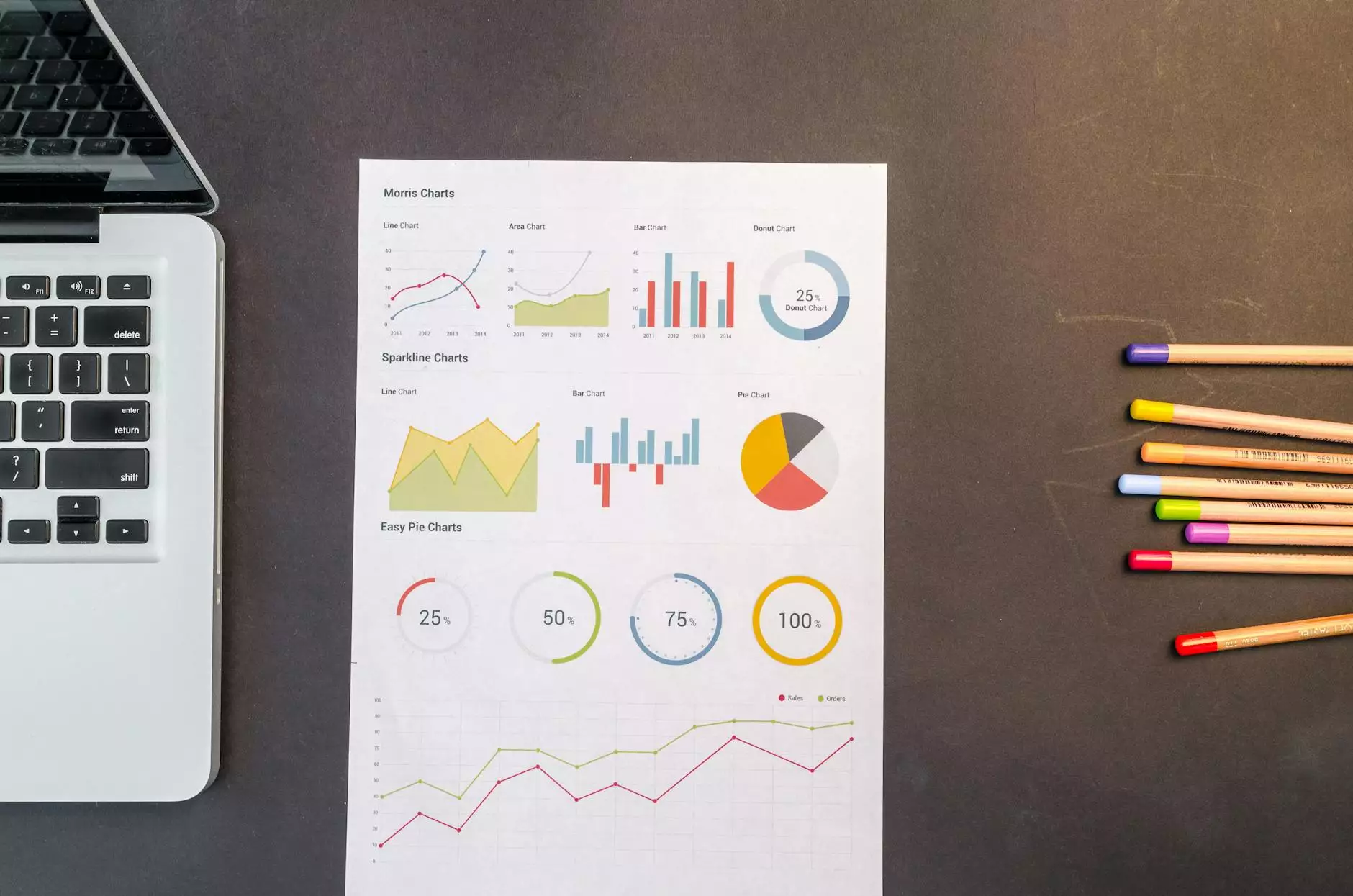

1. The Importance of Market Analysis

Successful trading begins with comprehensive market analysis. Prop firms employ a variety of techniques to analyze financial markets, including:

- Technical Analysis: This involves the examination of price charts and patterns to forecast future price movements based on historical data.

- Fundamental Analysis: Evaluating economic indicators, company earnings reports, and other economic factors that can impact market conditions.

- Sentiment Analysis: Understanding market sentiment through social media, news, and other public forums to gauge the market's emotional state.

By combining these analytical approaches, prop traders can make informed decisions that align with their prop firm strategy. This multi-faceted analysis allows for a more holistic view of the market landscape.

2. The Role of Risk Management in Prop Trading

In trading, risk management is paramount to sustaining profitability over the long term. Prop firms adopt several strategies to manage risk effectively:

- Diversification: Spreading investments across various instruments and asset classes to reduce exposure to any single point of failure.

- Position Sizing: Determining the appropriate amount to invest in each trade based on the trader's overall risk tolerance and capital allocation.

- Stop-Loss Orders: Implementing stop-loss orders to automatically sell assets when they reach a predetermined price, limiting losses on trades.

The implementation of these risk management tactics creates a safeguard against the inevitable volatility found in financial markets.

3. Trading Psychology and Emotional Discipline

Trading is as much a psychological challenge as it is a technical one. To succeed, traders at prop firms must cultivate strong emotional discipline. This can be achieved through:

- Establishing a Trading Routine: Creating a consistent routine helps traders gain focus and confidence.

- Using Journals: Keeping a trading journal to reflect on decisions made and their outcomes, facilitating continuous improvement.

- Practicing Mindfulness: Engaging in mindfulness exercises can help traders remain calm and reduce impulsive reactions to market fluctuations.

By mastering their trading psychology, traders can avoid the pitfalls of emotional trading, which can lead to significant losses.

4. Leveraging Technology in Prop Firms

In today's digital age, technology plays an integral role in enhancing trading strategies. Proprietary trading firms make extensive use of:

- Advanced Trading Platforms: Utilizing sophisticated trading software that offers real-time data and analytics.

- Algorithmic Trading: Employing algorithms to automate trading decisions based on statistical models, allowing for faster execution.

- Artificial Intelligence: Adopting AI-driven tools to identify patterns and trends in large data sets, helping to refine trading strategies further.

Incorporating these technologies into their operations enables prop firms to gain a competitive advantage in the market.

5. Developing a Robust Trading Strategy

The effectiveness of a prop firm strategy hinges on the trader's ability to create a robust plan that aligns with market dynamics. A well-crafted trading strategy includes:

- Defining Trading Goals: Establishing clear, achievable targets helps traders stay focused on their objectives.

- Choosing Trading Styles: Identifying whether to engage in day trading, swing trading, or long-term trading based on personal preferences and market conditions.

- Backtesting Strategies: Testing trading strategies against historical data to assess their viability and make adjustments accordingly.

A successful strategy not only increases the odds of profitability but also builds trader confidence in executing their trades.

Conclusion: Embracing the Prop Firm Strategy for Success

In summary, understanding and implementing effective prop firm strategies is crucial for anyone seeking to thrive in the competitive world of financial trading. By focusing on market analysis, risk management, trading psychology, leveraging technology, and crafting a robust trading strategy, traders can optimize their chances of success.

As prop trading continues to evolve, staying informed about the latest trends and adapting strategies accordingly will be vital for long-term success. Empowering yourself with knowledge and skills in these areas will not only enhance your trading capabilities but also pave the way for financial stability and growth.

For more information on prop firm strategies and trading tips, visit us at propaccount.com.